Homeowners Insurance in and around Macomb

Macomb, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- MACOMB

- MACOMB TOWNSHIP

- WASHINGTON

- WASHINGTON TOWNSHIP

- ROMEO

- BRUCE TOWNSHIP

- RAY

- RAY TOWNSHIP

- ARMADA

- SHELBY TOWNSHIP

- UTICA

- RICHMOND

- ALMONT

- ROCHESTER

- ROCHESTER HILLS

- CLINTON TOWNSHIP

- OXFORD

- NEW HAVEN

- IMLAY CITY

- DRYDEN

- MEMPHIS

- STERLING HEIGHTS

There’s No Place Like Home

Your home is a special place. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, a top provider of homeowners insurance. State Farm Agent Aaron Seitz is your reliable authority who can offer an insurance policy aligned with your unique needs.

Macomb, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

Open The Door To The Right Homeowners Insurance For You

From your home to your precious hobbies, State Farm can help you protect what you value most. Aaron Seitz would love to help you know what insurance fits your needs.

Don’t let the unknown about your home make you unsettled! Visit State Farm Agent Aaron Seitz today and discover how you can meet your needs with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Aaron at (586) 992-1175 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

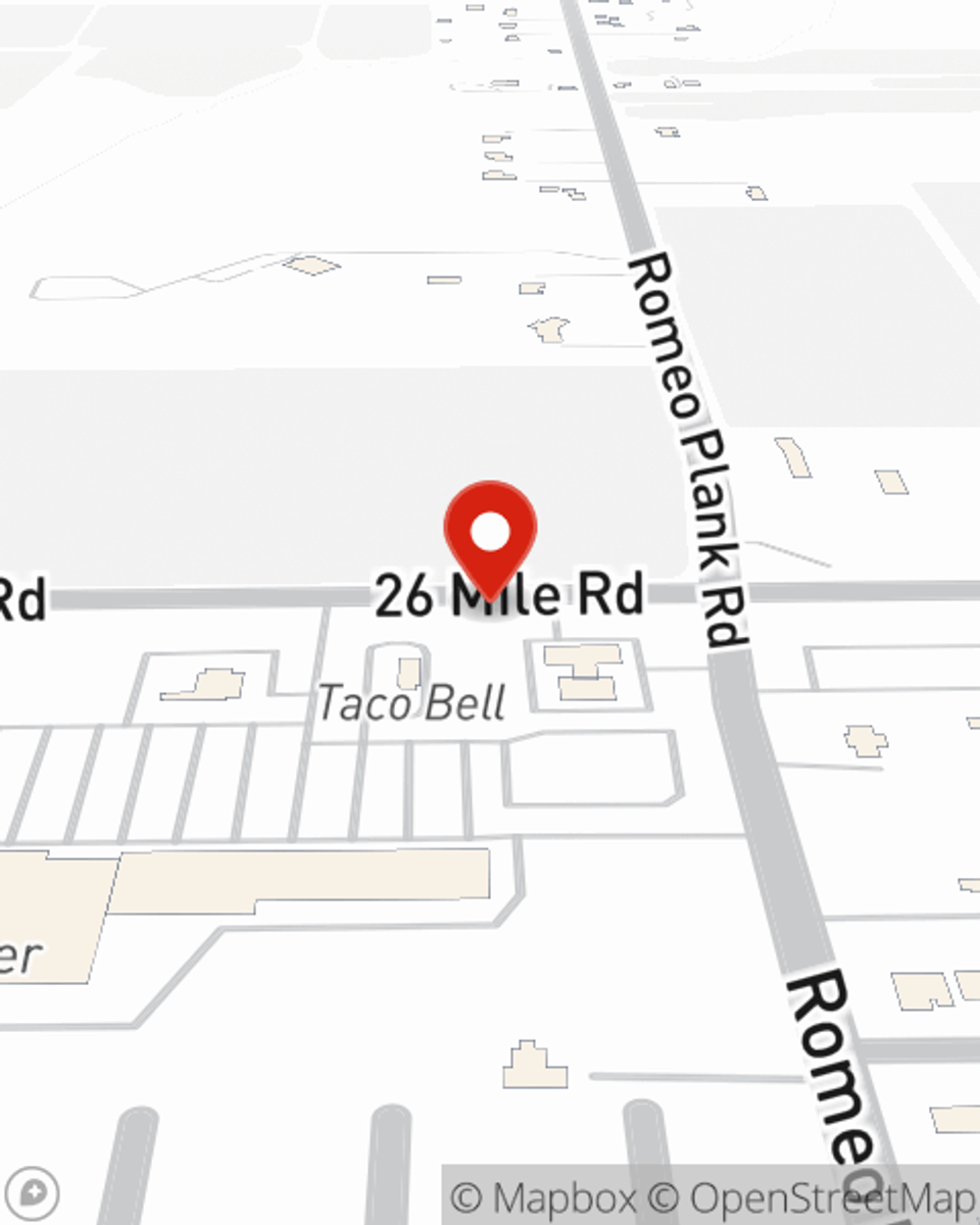

Aaron Seitz

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.